Drawing on 'lessons of loss' to improve discernment of investment risk in the 2026 Crypto Market

- Glyn MacLean

- Dec 16, 2025

- 15 min read

In this post I am going to share past lessons learnt from the causative nature of victim losses from my almost 10-years operating as a victim advocate. Then we will take a look at my personal research dillgence for a speculative future look at the 2026 Cryptocurrency Market.

FOR EDUCATIONAL PURPOSES.

Lessons from cyber, crypto and financial crime research and insights from assisting victims of fraud to assemble their evidence to seek justice.

Simple ideas distilled from 10-years of research into how victims of complex crypto investment fraud lost their wealth - could help some readers to prevent a future crime or prevent a simple and common costly mistake from happening to them or loved ones.

Knowing how to speculate around genuine crypto investment 'cause and effect' involves first taking a macro or zoomed out view of the big picture. Then come down into a micro or zoomed in up-close view of the detail of a specific category for 2026 investment.

My 2026 Crypto Investment Risk Category analysis is for educational purposes only. The aim is to help victims of financial fraud to see the real crypto big picture. To avoid fraudulent misrepresentation by understanding the genuine categories of crypto investment and where 2026 speculation is centered.

NB: This is not legal or financial advice. I am not a lawyer and not a financial advisor. You should seek that kind of advice from a person who is qualified, licensed and registered. AI has also been used to augment this post and while cross-checked, is still prone to error. Information on 2026 is purely speculative and is not definitive. Use this as a general educational guide to understand categories and general movement of the noted sectors. Let's get into it.

KEY POINTS from the LESSONS OF LOSS

SLOW DOWN! 'Take-Your-Time' (TYT) to conduct rational and logic-based due-dilligence on any investment in 2026.

AVOID EMOTIVE! Fear Of Missing Out (FOMO) based psychological cooercion and manipulation and 'invest-under-duress' unethical, fake and criminal investment schemes.

CHOOSE LICENSED! I am hoping that I can direct victims of investment fraud to seek out trained, licensed and registered investment advisors in their home country. Avoid exploitation through high-risk emotion-based and opportunistic speculation.

WISDOM of DILLIGENCE

INVESTMENT ADVICE

In most countries a person who gives financial investment advice is required to be certified, licensed and registered under strict guidelines for accountability.

There is a legal requirement for an unlicensed and unregistered investment advisor to place a disclaimer stating they are not licensed and registered and advice should be sought by someone who is authorised. A failure to add this disclaimer could get the 'advisor' in serious trouble. If the advisor or platform is not licensed or registered to provide advice and does not provide the disclaimer to seek advice from someone who is registered, they may already be breaking the law.

Understand the seriousness of risk with any person or entity operating an investment scheme from a territory with no regulatory protections.

An unregistered and unlicensed financial advisor is typically not a good natured Robin Hood. This person is usually Robbing the Hood.

UNLICENSED & UNREGISTERED

Any financial investment platform operating unlicensed and unregistered with a regulatory or licensing authority, and which does not operate from a jurisdiction that complies with common-law, is either extremely high risk or is likely to be criminal.

If credentials are promoted on a website check them directly with the regulatory authority. Don't take their (marketing) word for it. Go to the source.

Some fake crypto trading platforms had sophistiated fake-regulatory-validation that appeared real. Some copy legitimate documents and then change the details. Some will go as far as to lodge fake details with the regulatory authority, details that are fraudulent. Government agencies are not usually culpable for their failures.

Investment diligence must go beyond simple validation with the authority.

The authority must check the credentials of people they say meet the standard.

If fake credentials are accepted as real by an authority and you invested based on accepting the authority's trust from validation of the entity, then the authority may culpable for this if the circumstance meets the definition of the regulatory authority failing in their Specific Statutory Duties: If the law imposed a clear duty of care towards individual investors which was breached. This is hard to prove.

If there is a real registered company entity, there is the opportunity to sue the directors for their fraudulent mispresentation and breach of contract.

And of course if a crime can be proved, criminal prosection can ensue.

INDUSTRY PROTECTIONS

Under financial advisory licensing provisions there is an industry body insurance protection against bad advisors. This somewhat protects consumer investment from registered advisors who go bad and can assist with at least a proportion of restitution of any lost investment funds. A good reason to seek out someone who is licensed and registered with an industry body that has a compensation scheme.

FALSE SECURITY

Get used to the idea of differentiating these two ideas.

Funds you introduce.

Promised Gains that you make with your introduced funds.

It's already too late if you attempt to mitigate loss by testing being able to get back your introduced funds. Many fake crypto trading schemes did allow proof of funds extraction early on and which quickly disappeared later. This extraction validation only served to lull victims into a false sense of security and trust.

Note that if a platform is not regulated or licensed, it is most likely at the very least unethical and untrustworty and is more likely designed with criminal intent. The capital investment was lost the moment the funds were introduced. And lost despite positive tests to extract the funds.

REALITY CHECK: When victims have used an unlicensed and unregistered platform, their funds were already lost.

BASIC CONCEPTS: Understand that with return on investment, money is made when you buy, not when you sell. In other words, buy low, sell high is the commonly valued gain principle. Also, if it sounds too good to be true, it is probably not true. The better (more outlandish) the returns, the more likely it is to be scam.

This next bit is worth repeating.

In the last 10-years almost every victim of Cryptocurrency, Financial and Cyber Crime who lost their wealth was driven by the emotion of Fear of Missing Out on what seemed to be a Too Good To Be True Return on Investment. Here are a couple of fundamentals that I value.

The first idea of investment is the RETURN OF YOUR INVESTMENT. Let's call this the INTRODUCED FUNDS. The second idea of investment is gaining a RETURN ON TOP OF YOUR INVESTMENT. Let's call this your PROMISED GAINS. I mention this because across almost all cases victims of investment fraud are universally unable to seperate out their introduced (real) funds from the promised (fake/fraud) gains. Thus when reporting their losses, victims of complex financial crime often claim the total loss including fictious promised gains that were never real.

Promised gains are demonstrated on fake trading platforms but are a fraudulent misrepresentation of what is actually happening.

Penny trading style, manually manipulated engines and templates are used to visually demonstrate inflows, gains and outflows, but are not connected to a real network at all. The digital assets you are sending are going to an individual or group who now have custody.

The catch is that in some instances the criminal has masterminded implicating another victim as the mastermind and as a money laundering mule. You may be sending money to another victim who now thinks that your address is the criminal address.

Implicating victims as crime bosses and money laundering mules is standard operating procedure in a large number of cases.

This information does not show on chain. It comes from ever evolving victim testimony, but only after developing interiewer trust and a victim-advocate bond are formed. This is often not a detail given to law enforcement in FBI IC3 Cybercrime reporting. Victims of complex crime often omit important details for fear of getting into trouble themselves. They are often afraid of and mistrust law enforcement.

This is for good reason.

In one case the evidence provided assisted to catch the criminals. The family never ever heard back about any potential restitution. Three elderly family members died from lack of funds intended for their private medical care. A financial complaints authority favoured a regulated exchange that had allowed criminals to use the platform. The victims were punished by the financial complaints authority. Meanwhile the exchange went on unpunished and the directors became multimillionaires depsite failing to stop criminal laundering. Speaking of Justice System trust...

To add insult to injury, unattributed recovered crypto assets are in some instances being absorbed into Justice Department Budgets.

To clarify, instances of digital assets being relabelled as 'proceeds of crime', which then can be used to pay for Law Enforcement training from seized asset funds pools. Overpriced Blockchain Investigation software and training can reach as high as USD100,000 per person per annnum. This is victim funds being relabelled by law as proceeds of crime and repurposed without any transparency or accountability. Victims perceive this as a secondary theft and an abberation of government ethics and morality. This does not represent people. Back to the crooks.

The fake cryptocurrency investment and trading platform is built on a manual, visual manipulation. A visual projection like 'Wizard of OZ' or 'Plato's Cave'. The victim is seeing a projected reality in professional looking trade figures. These are often manual inputs.

Mobile programming languages like Python and JavaScript use initial web hooks from fake investment domains to open dApps right inside DeFi crypto wallets. These mini app programs look like legtimate Trust Wallet and other DeFi wallet brands.

There is no security layer or barrier whatsoever to opening a fake mini-program inside a real cryptocurrency wallet. Therein lies the industry oversight. In order to reduce customer friction, major DeFi vendors have left gaping holes in Web3 security that are actually a primary cause of systemic failure and loss.

Unless you have the technical competency to study all of the technology code bases used by criminal programmers and map out the technology road map or pathway, you will never see the technology stack being used by the criminals to commit enterprise scale crime. Notably, many of the criminals were trained either at universities or (and) are involved in pentesting communities, hiding in plain sight. This is not anecdotal. I have tracked them ny decoding JavaScript signatures. Changes to SmartContracts are critical to monitor and mitigate risk.

The criminal aims to access more victim introduced funds by manipulating emotions. Then introduces time-sensitive principle or initial funds introduction timelines as a form of coercion-under-time-based-duress using FOMO. (Fear of Missing Out.)

This is just a tiny fragment of 10-years of lessons of loss. Let's prevent this from happening again with future insight.

Determining RISK vs REWARD in 2026 Crypto Investment

In this next part of the article we are going to take a strategic approach to get you started on how to examine crypto investment risk factors, including identifying Risk vs Reward from key opportunity areas for Cryptocurrency in 2026.

I have shared links (below) to source-articles that discuss risk vs reward along with potential for return of your initial introduced funds (ROIF) and your return on investment (ROI) and the promised gains. (ROIF is my invention and just for the record I was ANZ Head of Business Advisory at Attache Software training Accountants to conduct client advisory.)

Current State of the Crypto Market in December 2025

Quick Take: In December 2025, the crypto market is consolidating with Bitcoin around $89,627 USD and Ethereum near $3,128 USD, while total market capitalization sits at $3.15 trillion USD. (note my comment about VOLATILITY below.)

Early 2026 is expected to bring

regulatory clarity,

institutional adoption,

and tokenization of real-world assets,

likely pushing valuations higher and reshaping the sector.

The crypto market in December 2025 shows a complex picture of growth, volatility, and shifting investor interest. As the year closes, understanding where capital is flowing and what sectors promise the best risk and reward balance is crucial for anyone involved in digital assets. This report breaks down the current state of the market, forecasts the outlook for early 2026, and provides an analysis of the top five crypto sectors by their risk and reward potential in USD terms.

Market Capitalization:

The global crypto market cap is $3.15 trillion USD, down 0.5% on December 15.

Bitcoin (BTC):

Trading at $89,627 USD, with analysts noting $74,000 USD as a critical support zone.

Ethereum (ETH): Slightly up at $3,128 USD.

Trading Volume:

Daily trading volume is $94.3 billion USD, lower than recent months.

Volatility:

Bitcoin fell to $84,000 USD earlier in December before rebounding toward $87,000 USD, showing sharp swings.

Institutional Moves:

American Bitcoin Corp now holds 5,044 BTC valued at ~$453 million USD, signaling continued institutional accumulation.

Presales:

Pepeto (PEPETO) raised over $7 million USD in December presales, highlighting investor appetite for utility-driven tokens

Volatility remains a defining feature, with daily price swings averaging 4-6% for major coins. Regulatory clarity in key markets such as the US and EU has improved, reducing some uncertainty but also introducing compliance costs that affect smaller projects.

Forecast for Early 2026:

Market Trends and Capital Flow

Looking ahead to early 2026, the crypto market is expected to grow steadily, settling after 2025 year end and early 2026 volatility at somewhere in the vicinity of greater than 3 trillion USD by Q2. Growth is likely to be uneven across sectors, with some sectors poised for rapid gains and others facing headwinds. Volatility.

Early 2026 Outlook (USD Context)

Analysts forecast a structural shift in crypto markets:

• Regulatory Clarity:

The U.S. passed stablecoin legislation in late 2025,

laying groundwork for compliance-driven growth.

• Institutional Adoption:

Grayscale predicts 2026 as the “dawn of the institutional era”,

with wealth managers and funds integrating crypto

into mainstream portfolios.

• Bitcoin Trajectory:

Many expect Bitcoin to reach new all-time highs in early 2026,

breaking past the four-year cycle theory.

• Ethereum & Layer-2s:

Ethereum consolidates near $3,112 USD (December 14)

and Layer-2 scaling will be critical for adoption.

• Tokenization:

Real-world asset tokenization (real estate, bonds) and stablecoins are

forecast to dominate, bridging blockchain with traditional finance.

• DeFi Evolution:

Improved user experience and compliance-ready

DeFi platforms could accelerate adoption.

Key Themes to Watch

Macro Liquidity:

Fed rate cuts (target range 3.50–3.75%) and BoJ hikes will continue to drive volatility.

Institutional Capital:

Expect inflows from ETFs, pension funds, and sovereign wealth funds.

Utility Over Hype:

The market is shifting toward projects with real-world use cases rather than speculative meme coins.

Capital Flow Breakdown

DeFi continues to attract institutional investors seeking yield opportunities beyond traditional finance.

Stablecoins maintain their role as a safe harbor amid volatility, with growing adoption in cross-border payments.

Tokenization of real-world assets is gaining momentum, especially in real estate and art markets.

Gaming tokens benefit from the rise of blockchain-based games and metaverse projects.

AI-linked tokens are emerging as speculative but high-potential assets, driven by advances in AI integration.

Investors are expected to allocate capital cautiously, favoring sectors with clear use cases and regulatory compliance.

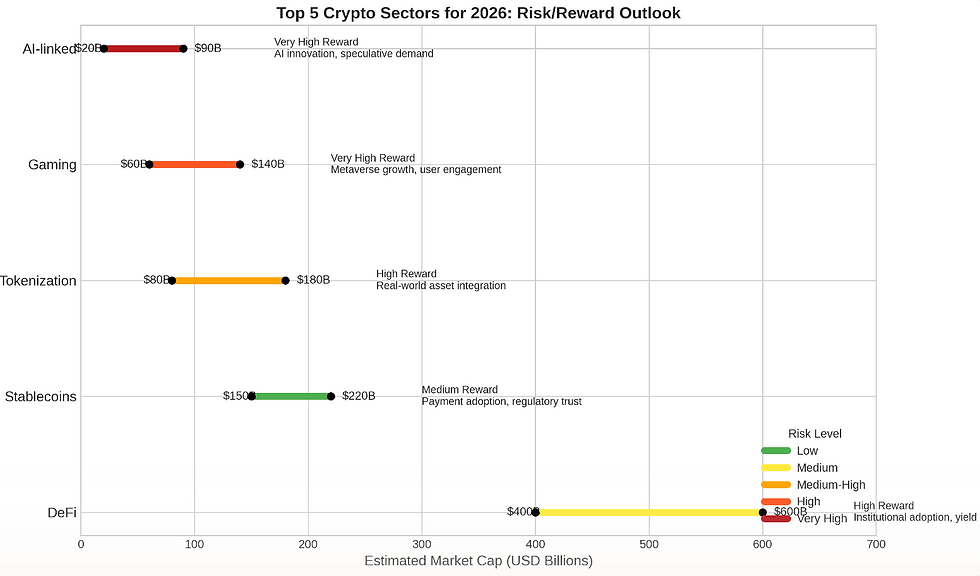

Top 5 Crypto Sectors for 2026

with Risk/Reward Outlook in USD Terms

........................................................................................................................................

Sector Est Market Cap Risk Level Reward Key Drivers

Growth (USD) Potential

.........................................................................................................................................

DeFi $400B → $600B Medium High Institutional adoption, yield

Stablecoins $150B → $220B Low Medium Payment adoption, regulatory trust

Tokenization $80B → $180B Med-High High Real-world asset integration

Gaming $60B → $140B High Very High Metaverse growth, user engagement

AI-linked $20B → $90B Very High Very High AI innovation, speculative demand

DeFi (Decentralised Finance)

DeFi platforms are expected to grow by 50% in market cap, reaching around $600 billion USD. The sector balances moderate risk with strong reward potential due to increasing institutional interest and innovative financial products. However, smart contract vulnerabilities and regulatory scrutiny remain risks.

Current TVL (Dec 2025): ~$120 billion USD.

Risk: Medium-High — smart contract exploits and regulatory oversight.

Reward: High — compliant DeFi could expand TVL to $250–300 billion USD in 2026.

Key Driver: Institutional-grade lending, derivatives, and decentralized exchanges.

Stablecoins

Stablecoins offer the lowest risk profile, with steady growth to about $220 billion USD. Their use in payments and as a hedge against volatility supports demand. Regulatory frameworks are tightening but generally favor stablecoin adoption.

AND

Tokenization

Tokenization could more than double in value, reaching $180 billion USD. This sector faces medium to high risk due to legal complexities and market adoption challenges but offers high rewards by unlocking liquidity in traditionally illiquid assets.

Current Market Size: ~$1.3 trillion USD in stablecoins.

Risk: Low — regulatory clarity in the U.S. and EU stabilizes growth.

Reward: Very High — tokenized bonds, real estate, and commodities could add trillions USD in market cap.

Key Driver: Compliance-ready platforms bridging TradFi and DeFi.

Gaming

Gaming tokens carry high risk but also very high reward potential, with market cap possibly more than doubling to $140 billion USD. The sector’s success depends on user adoption of blockchain games and metaverse projects.

AND

AI-linked Tokens

AI-linked tokens are the most speculative, with potential growth from $20 billion to $90 billion USD. This sector’s risk is very high due to nascent technology and uncertain regulatory treatment, but the reward could be substantial if AI integration accelerates.

Current Market Size: ~$50 billion USD combined.

Risk: High — speculative hype and fragmented ecosystems.

Reward: Medium-High — AI-integrated tokens and blockchain gaming could reach $150 billion USD by 2026.

Key Driver: AI-driven productivity tokens, play-to-earn models, and metaverse adoption.

ALSO NOTABLE OF COURSE are the CRYPTO CORNERSTONES: Bitcoin and Ethereum remain the backbone, but stablecoins and tokenization are the stealth growth engines, while DeFi and AI-linked tokens offer asymmetric upside with higher risk.

Bitcoin (BTC) & Store-of-Value Assets

Current (Dec 2025): ~$89,627 USD

Risk: Medium — volatility tied to macro liquidity and regulation.

Reward: High — institutional adoption could push BTC past $150,000 USD in 2026.

Key Driver: ETFs, sovereign wealth funds, and corporate treasuries accumulating BTC.

Ethereum (ETH) & Layer-2 Scaling

Current (Dec 2025): ~$3,128 USD

Risk: Medium — competition from Solana, Avalanche, and regulatory scrutiny.

Reward: High — Layer-2 adoption could drive ETH toward $6,000–$8,000 USD in 2026.

Key Driver: Rollups, staking yields, and enterprise adoption of smart contracts.

VISUALISED CRYPTO SECTOR

RISK vs REWARD OUTLOOK

How to Read the Chart

X-axis (Risk): Left to Right. Bottom. Risk Moves from Low → High.

Y-axis Bottom Left to Top Left. (Reward Potential in USD billions): Shows the upside each sector could deliver. Granted that not everyone can benefit from Stable Coins.

Labels: Each point is annotated with the sector name and projected USD value.

Risk vs Reward Chart for Top 5 Sectors

| Sector | Risk (1-5) | Reward (1-5) |

| DeFi | 3 | 4 |

| Stablecoins | 1 | 3 |

| Tokenization | 4 | 4 |

| Gaming | 5 | 5 |

| AI-linked | 5 | 5 |

Alternate view:

This chart shows that while stablecoins offer the safest investment, gaming and AI-linked tokens provide the highest potential returns but with significant risk.

Risk/Reward Summary

Key Takeaways from the Chart

• DeFi ($400B → $600B USD):

Medium risk, high reward. Driven by institutional adoption and yield opportunities.

• Stablecoins ($150B → $220B USD):

Low risk, medium reward. Growth tied to payment adoption and regulatory trust.

• Tokenization ($80B → $180B USD):

Medium-high risk, high reward. Real-world asset integration is the main driver.

• Gaming ($60B → $140B USD):

High risk, very high reward. Fueled by metaverse expansion and user engagement.

• AI-linked ($20B → $90B USD):

Very high risk, very high reward. Speculative demand and AI innovation dominate.

Where and When Capital Is Most Likely to Flow

Investors will likely prioritize sectors with a balance of growth and manageable risk. DeFi and tokenization stand out as sectors where capital will flow steadily due to their practical applications and growing adoption. Stablecoins will continue to serve as a liquidity base and safe haven. Gaming and AI-linked tokens will attract speculative capital, especially from retail investors and venture funds looking for high returns.

Timeline Forecast for Sector Peaks in 2026

| Quarter | DeFi | Stablecoins | Tokenization | Gaming | AI-linked |

|---------|------|-------------|--------------|--------|-----------|

| Q1 | Moderate growth | Steady growth | Early adoption | Initial surge | Speculative interest |

| Q2 | Peak growth | Stable | Growth phase | Rapid growth | Volatility spike |

| Q3 | Plateau | Stable | Peak growth | Peak growth | Potential correction |

| Q4 | Consolidation | Stable | Consolidation | Correction | Recovery or decline |

DeFi is expected to peak in Q2 as new protocols launch and institutional funds flow in.

Stablecoins will maintain steady growth throughout the year.

Tokenization will see its highest growth in Q3 as regulatory clarity improves.

Gaming tokens will peak in Q3, driven by major game releases and metaverse expansions.

AI-linked tokens may experience a volatile peak in Q2, followed by corrections and possible recovery by year-end.

Risk/Reward Summary

DeFi offers a strong balance of risk and reward, suitable for investors seeking growth with moderate caution.

Stablecoins provide safety and liquidity but limited upside.

Tokenization is a high-reward sector with legal and adoption risks.

Gaming tokens are highly volatile but could deliver outsized returns.

AI-linked tokens are speculative bets with potential for large gains or losses.

Investors should diversify across these sectors to manage risk while capturing growth opportunities. By now you would get the gist of Risk vs Reward across Cryptocurrency Investment Categories. A sense of the market volatility and the factors that stabalise. And a sense of sensibility around connecting cryptocurrencies to real world projects.

ARTICLE ENDS.

FOOTNOTE:

BLOCKCHAIN INSIGHTS I have lectured previously on BLOCKCHAIN IDEATION. A lecture which includes the diffusion of innovation across the adoption bell curve. Walking through many of the major and future

technological innovations associated with blockchain and cryptocurrency and knowing how they work through examples in simple terms with accurate knowledge of their limitations. Visualising the technology stack to innovate cost reduction through industry standardisation, data interchange and interoperability. Some of this knowledge equity flows from my experience in industry transformation across the FinTech industry. I have however studied daily for decade and come into deep knowledge of encryption, cryptography, quantum computing, artificial intelligence and convergences. If this interests you please sing out. FUTURE INSIGHTS Next year I will get onto talking about mobile crime technologies. I have studied the emergence of DIY Raspberry PI and Flipper Zero with ESP32 Marauder Cards and similar pocket sized technologies, including covert mobile networks like LoRa and Mestastic. I think my audience will love learning about FBI STINGRAY and how that has inspired SMISHING, Cell Tower Emulators and other technologies coming onto the threat theatre in 2026. Stay safe out there. Lest we forget,

Jesus is the reason for the season.

LOVE YOUR NEIGHBOUR AS YOURSELF.

Whatever faith you hold, don't lose faith in humanity. With love and Merry Christmas. Glyn

Addendum: Sources and Evidence Chain

CoinMarketCap – Market capitalization and price data for December 2025

DeFi Pulse – DeFi sector growth and institutional adoption reports

Stablecoin Regulatory Updates – US and EU regulatory frameworks

https://www.sec.gov, https://eur-lex.europa.eu

Tokenization Market Analysis – Real-world asset tokenization trends

https://www.tokenizationreport.com

Gaming and Metaverse Reports – Blockchain gaming market forecasts

https://www.blockchaingamingnews.com

AI-linked Token Research – AI integration in crypto and speculative trends

https://www.aicryptoinsights.com IMPORTANT DISCLAIMER:

This post represents opinion only and is based on a personal analysis of cryptocurrency and diseminating source data for context. The aim has been to assist and guide the victims of complex financial fraud into a habit of due diligence. This post is not professional financial or investment advice. Please note that I am not a registered investment advisor. My readers should seek advice only from a professional, registered investment advisor in the country in which they live and are invited to check sources and conduct their own diligence. Many of the figures represented in this post will be incorrect by the time they are read. During the writing of this post figures varied wildly and it was impossible to maintain accuracy due to volatility. Please treat the numbers as indicative.